In Parts 1 and 2 of this four-part series, we identified the three main reasons we’ve found that companies fail at federal contract business development:

- Too few opportunities in the pipeline to meet growth goals

- No review process to check each opportunity’s capture progress

- Submitting general proposals that don’t answer the Government’s requirements

In this part, we’re going to focus on the second reason — lack of a formal, disciplined, and diligent review process. The essence is: At the very least, business managers need to conduct a bi-monthly pipeline review and an interim check on each individual opportunity. No one likes to do pipeline/opportunity reviews. So, leadership and buy-in have to come from the top. As soon as the BD lead steps away or delegates it, the whole process falls apart. Your Government opportunities pipeline is a funnel, and business development leadership should be looking to disqualify opportunities at each review, or “Gate.” You must input enough opportunities so that you have enough qualified opportunities to bid on after all the filtering. And by bidding “enough,” we mean enough opportunities to meet your growth goals while taking into consideration your win rate. Next, we’re going to review the different gates and the metrics you should be tracking to measure your effectiveness managing your pipeline.

Gate Reviews

A Gate Review is essentially an opportunities pipeline review. The goal at each gate is to no-bid the opportunities that are a waste of time, identify opportunities that look good but need more research, and/or fund the opportunities that you want to bid on. There are three formal Gate Reviews in a normal opportunity lifecycle, but we’ll add a fourth review that we call Gate 0. In order, the Gate Reviews go like this:

Gate 0: Interest-No Interest

From the universe of opportunities, someone has to do the initial filter and pull in the opportunities that look good, without going in-depth. It’s not just about doing enough research. It’s also about serious consideration — including brainstorming with your BD team and leadership — about the strategic direction of your company in the marketplace. Here are the relevant questions to help you pull good opportunities into your pipeline:

- What socioeconomic categories should we target?

- Which North American Industry Classification System (NAICS) codes and Product Service Codes (PSCs) or Federal Supply Codes (FSCs) apply to our past performance?

- What work interests us that we want to target? What do our top performers and SMEs aspire to do for their own careers and for the company?

- Which customers do we know? Do any already favor us? Which new clients do we want to target? Do we need to develop new or expanded capabilities because our target client generally bundles our services with other work?

- What contract vehicles do our target clients use? How do we get on those vehicles?

- What are our competitors doing? What are they doing well? Where are they falling short? Where can we make a difference?

- What is the ideal contract size and scope we can undertake? (We want to stretch and grow, but we don’t want to be overwhelmed. The customer will think us too risky if we promise more than they believe we can deliver.)

- What products and services do we have to offer? Which do we plan to develop? What type of contract would underwrite those efforts? Which would provide convincing past performance for relevant future bids?

Having answered these questions, use the answers to perform your first filter. If you don’t have enough information, then you have to go back and do more market research. Fifty percent of the opportunities put into the pipeline at this stage should pass to the Gate 1 review.

Gate 1: Qualified-Not Qualified

An opportunity needs three things to qualify it:

- Customer: you must identify who will make the buying decision.

- Need: the customer must have a need that you understand and can fulfill.

- Budget: the opportunity must be funded, or you understand that it will be funded as funding becomes available.

A lot of companies struggle to find prospective buyers, but this is a critical piece to the capture phase. To identify individual buyers:

- Identify and attend Vendor Outreach events such as Industry Days and professional conferences. (These days, those are increasingly being conducted as virtual meetings online.)

- Search OSBDU.gov for the contacts on specific contracts in your area of expertise.

- Search agency websites for their organization charts.

- Identify the Contracting Officer (CO), the Contracting Officer’s Representative (COR), the Program Manager (PM), and contact information for the Program Management Office (PMO).

- Look at other agencies that buy similar offerings (such as searching for associations and industry groups), Bloomberg Government Agency Contacts, GovSearch (formerly Caroll Publishing, shown in Figure 1) Directory and Org Charts, GovWin IQ Org Charts, or whatever capture intelligence database you use.

Figure 1. GovSearch Website. Here you can find org charts of prospective customer agencies.

You must find out these three things before you can qualify an opportunity, and you have to do it for every opportunity in your pipeline. If you can’t, or you’re spending too much time on one, then no-bid the opportunity and move to the next one. Seventy-five percent of these opportunities should pass to Gate 2.

Gate 2: Capture Status Review

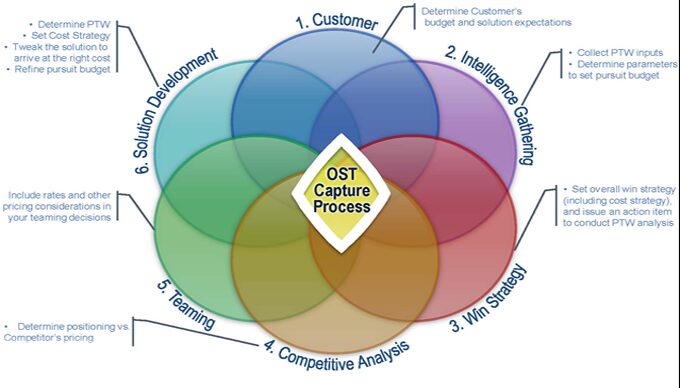

This review can also be called a Blue Team. At this review, the capture manager will present their findings and status. The capture manager will present the progress made in capture through customer engagement, intelligence gathering, win strategy, competitive analysis, teaming, and solution development to BD leadership. Figure 2 shows OST’s capture process overview. At this gate, the team needs to decide whether you should continue committing money to this opportunity or if it’s time to move to the next opportunity.

Figure 2 OST Six-Phase Capture Process. The major question to ask at this review is whether the win strategy is likely to result in a realistic chance at winning the opportunity. Remember that you shouldn’t continue to throw good money after bad, so be harsh on your capture managers if they show up without a good status report. Ninety percent of these opportunities should pass to the next gate.

Gate 3: Bid-No-Bid Review

When the RFP drops, analyze the solicitation for changes, ensure you’re still capable and ready, and proceed to proposal development if there is a high likelihood of winning. This should be a formality but the Government has been known to throw a curveball or two. While leadership is conducting the bid-no bid review, the proposal team should be starting on the outline and kickoff package.

Reach Out for Professional Help

As you can see, if you don’t put enough opportunities into the pipeline, then you may have nothing to bid on after Gate 3. OST consultants are experts in managing pipelines, conducting capture, and helping develop outstanding proposals. Reach out to us if you’re struggling to fill and manage your pipeline. We can provide a demo of our pipeline tool that provides the workflow and metrics necessary to grow and manage your pipeline the right way. Moreover, we offer the best professional training available on how to grow your Government contract business, check out our Bid & Proposal (B&P) Academy to empower your team to win and grow your company.

Contact us to learn more.